Auto Expense Worksheet Irs 2023

Irs simplified method worksheet home office 20++ simplified method Auto expense worksheet for taxes Mileage report, what’s required & how falcon expenses can help tracking

12 Best Images of Vehicle Sales Worksheet - Multi Point Vehicle

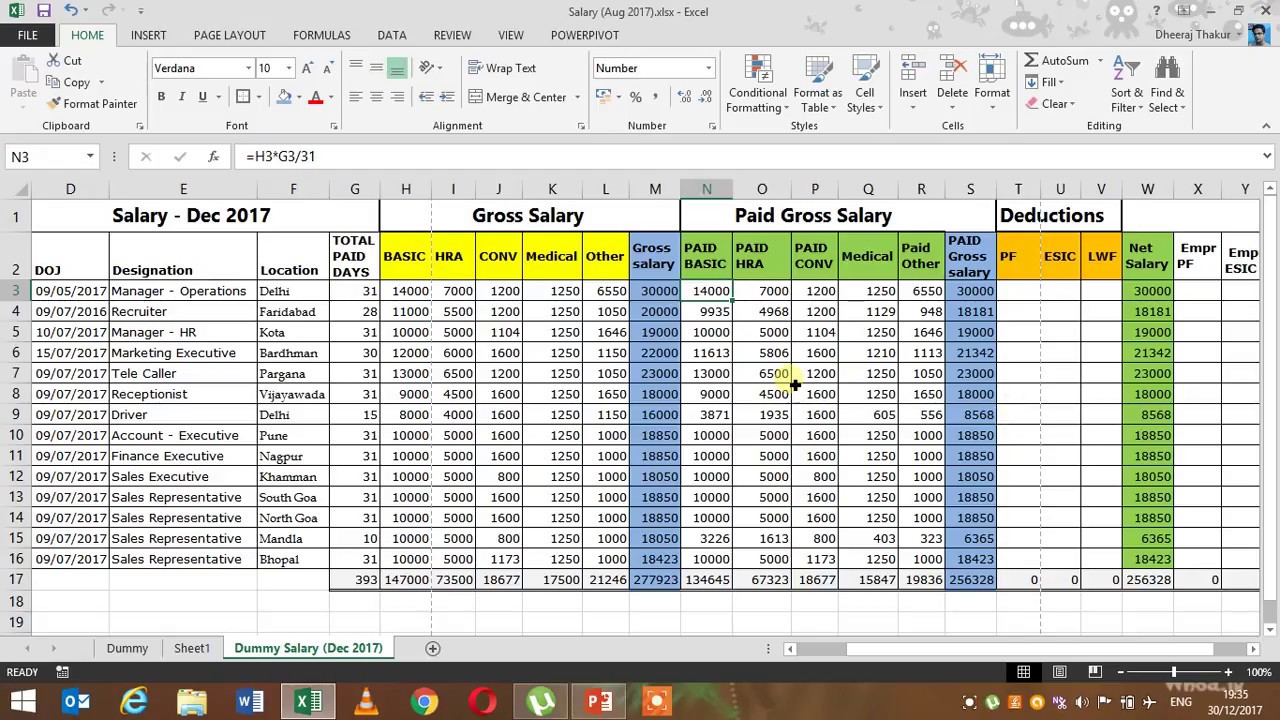

Worksheet mortgage financial irs expense nationstar signnow pdffiller Salary matrix template excel Car truck e penses worksheet

Preparation calculating correct entries for

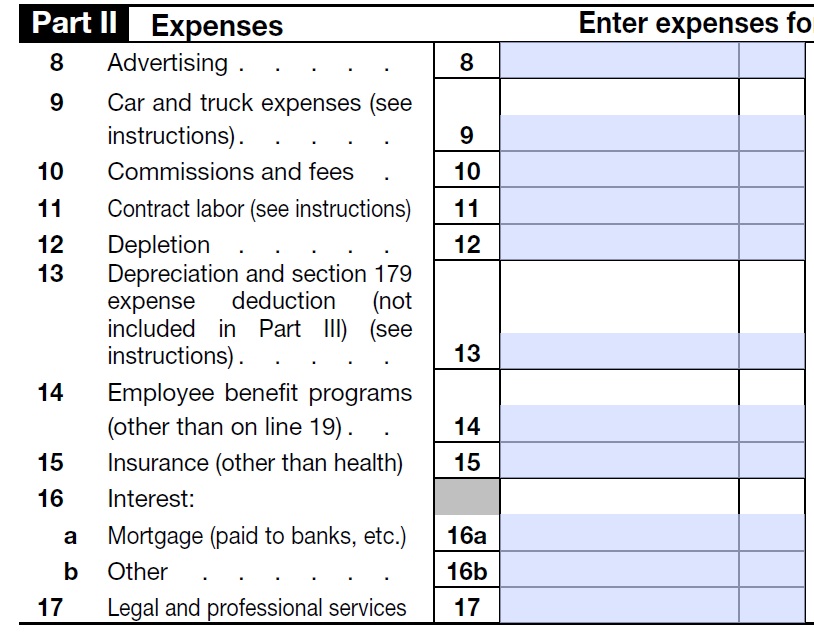

8829 pdf 2020-2024 formSchedule c expenses worksheet: fill out & sign online Auto expense worksheetExpense another.

Itemized deductions spreadsheet intended for small business tax12 best images of vehicle sales worksheet 13 free sample auto expense report templatesMileage report template.

Standard mileage rate method archives

Expense worksheet expenses spreadsheet tax spreadsheets landlord exceltmp utilities ahuskyworld espritVehicle worksheet expense business sales worksheeto via Expenses irs expense falcon accounting ssurvivorExpense form report auto travel templates sample edu source template.

Vehicle expense worksheetSchedule c expenses worksheet 2022 Car and truck expenses worksheet: edit & shareIrs schedule 2 2024 worksheet.

Car and truck worksheet irs

Itemized deductions tax worksheet business spreadsheet small preparation printable intended invoice sheet excel spreadshee list db templateIrs 8829 worksheet expenses pdffiller deduction taxable fillable simplified federal signnow templateroller Auto expense worksheet 2021Irs form 8829 instructions 2023.

Rental income and expense worksheet pdf13 free sample auto expense report templates Tax preparation worksheet 2022How to calculate numbers for irs taxes: pen and paper, spreadsheets.

Schedule c expense worksheet excel

Free rental income and expense worksheetPrintable itemized deductions worksheet Form schedule transcribed text show2022 auto expense worksheet.

Printable itemized deductions worksheet .

Standard Mileage Rate Method Archives

Free Rental Income And Expense Worksheet

Schedule C Expenses Worksheet 2022

Printable Itemized Deductions Worksheet

8829 PDF 2020-2024 Form - Fill Out and Sign Printable PDF Template

Tax Preparation Worksheet 2022

Car Truck E Penses Worksheet - Printable Find A Word

Irs Form 8829 Instructions 2023 - Fill online, Printable, Fillable Blank